Looking for the best insurance rates in NC? Dive into this guide to uncover the secrets of getting the most affordable coverage in North Carolina. From factors affecting rates to tips for finding the best deals, this comprehensive overview has you covered.

Factors Affecting Insurance Rates in NC

In North Carolina, several key factors influence insurance rates. These factors include the driver’s age, driving record, type of vehicle, location, and coverage options. Insurance companies in NC consider these factors when determining the rates for their policies.

Identifying Key Factors, Best insurance rates in nc

- Driver’s age: Younger drivers typically have higher insurance rates due to their lack of driving experience.

- Driving record: Drivers with a history of accidents or traffic violations may face increased insurance premiums.

- Type of vehicle: The make and model of the vehicle can impact insurance rates, with sports cars and luxury vehicles often costing more to insure.

- Location: Urban areas with higher rates of accidents or theft may result in higher insurance premiums.

- Coverage options: The level of coverage selected, such as liability, comprehensive, or collision, can affect insurance rates.

Types of Insurance Available in NC

North Carolina offers various types of insurance policies to meet different needs. These include auto insurance, homeowners insurance, renters insurance, health insurance, and life insurance. Each type of insurance provides specific coverage tailored to protect individuals and their assets.

List of Insurance Types

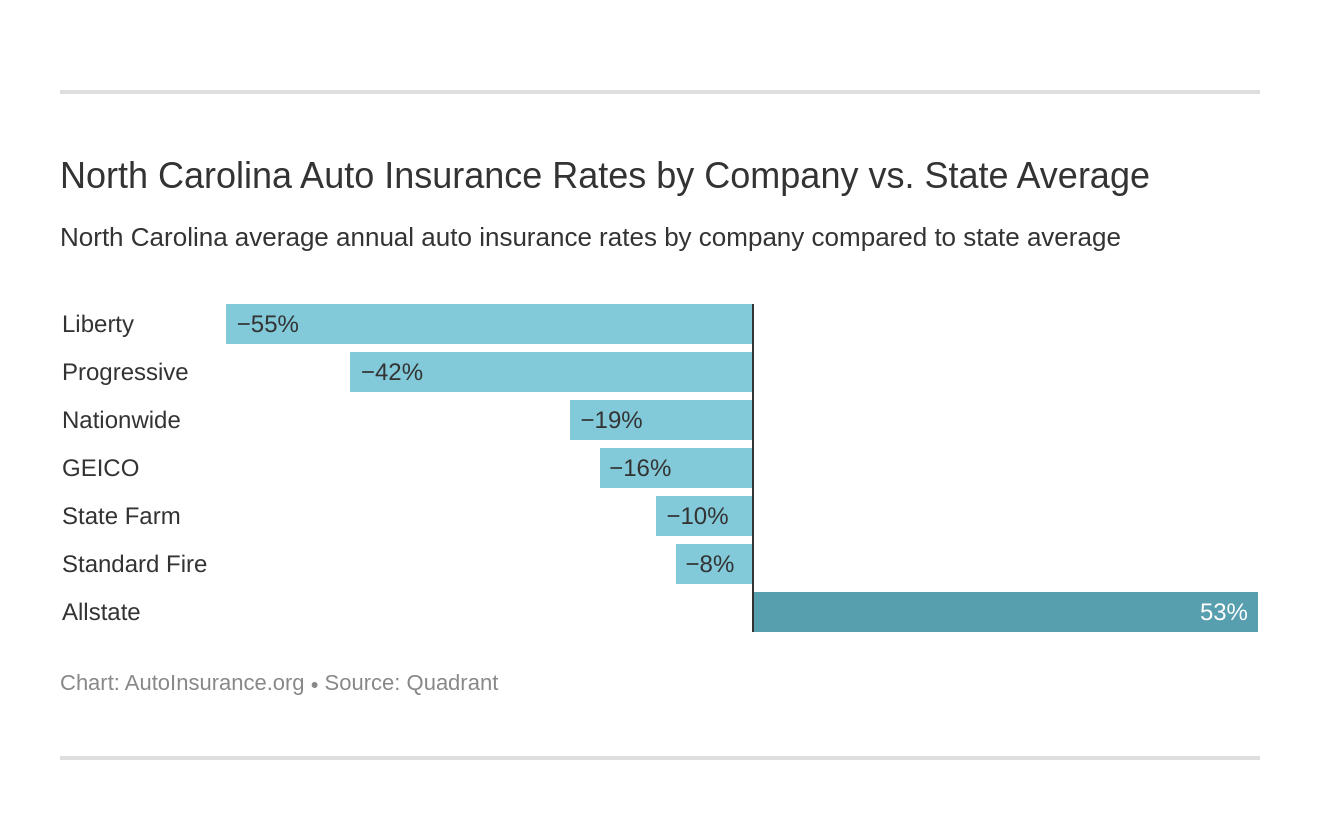

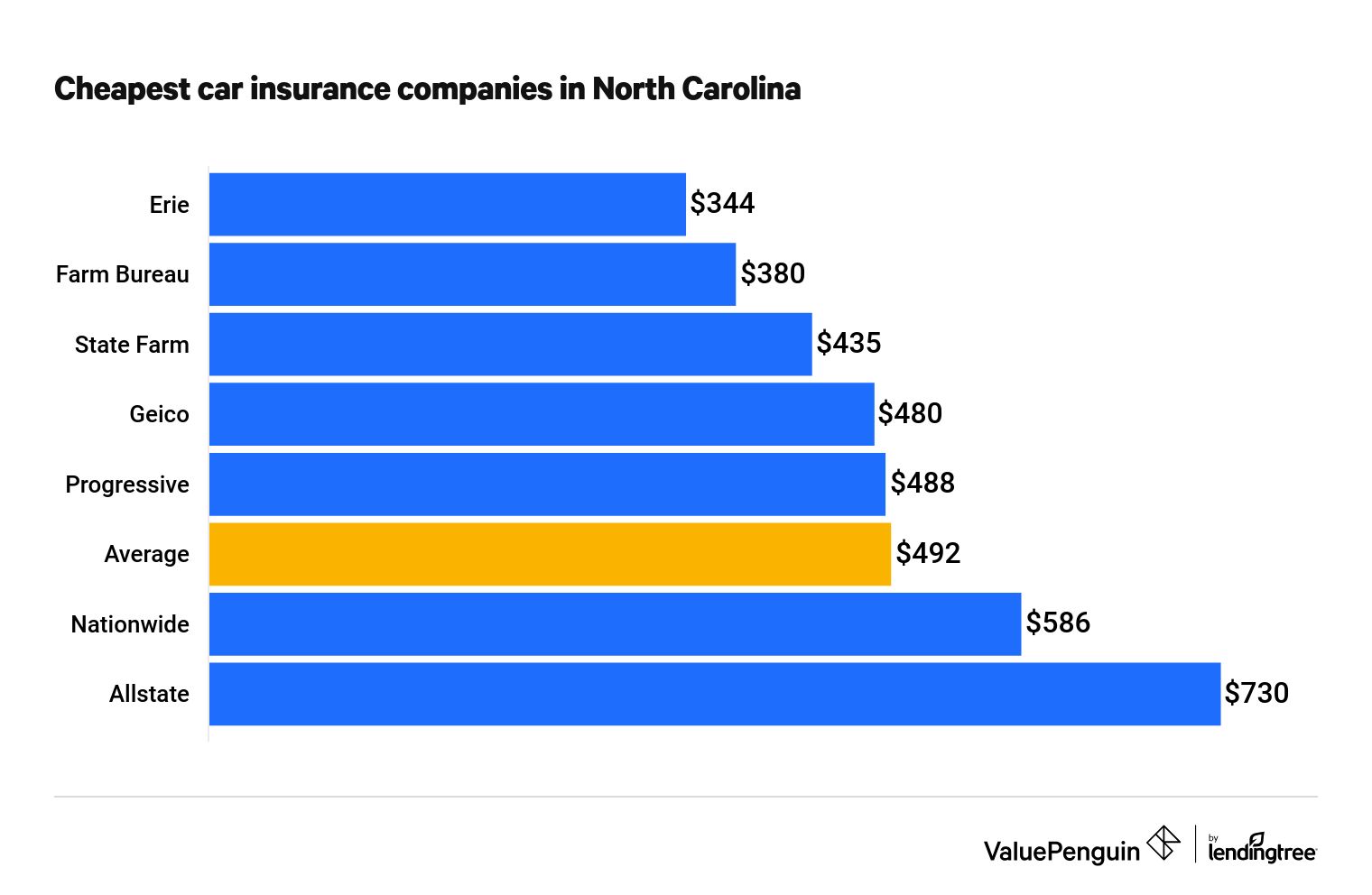

- Auto insurance: Covers damages and injuries resulting from car accidents.

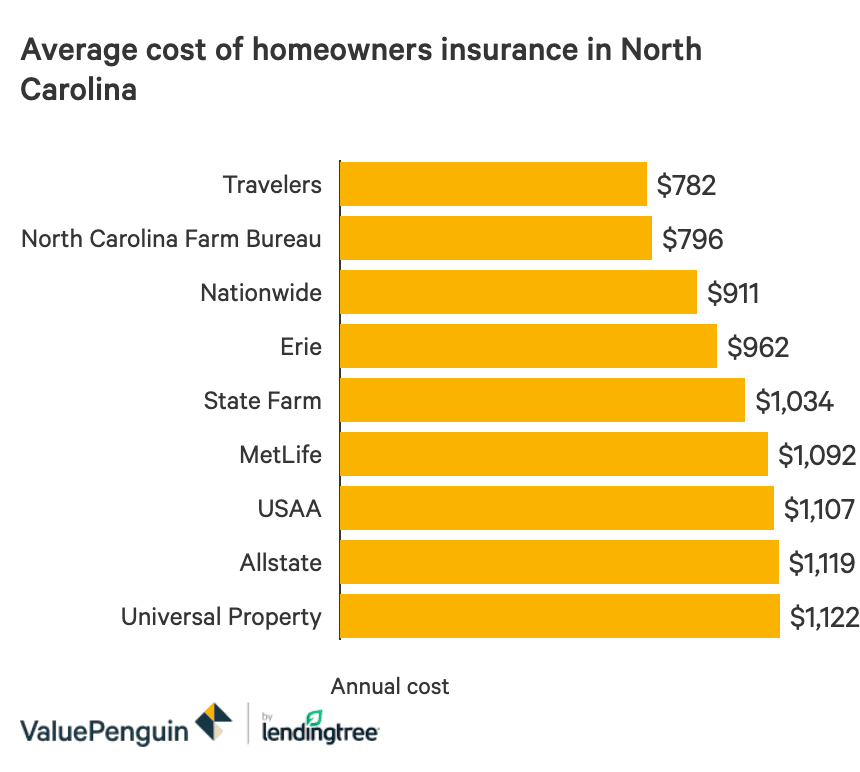

- Homeowners insurance: Protects against damage to the home and personal property.

- Renters insurance: Provides coverage for personal belongings in a rented property.

- Health insurance: Offers financial assistance for medical expenses and healthcare services.

- Life insurance: Provides a death benefit to beneficiaries upon the insured’s passing.

Tips for Finding the Best Insurance Rates in NC

When searching for the best insurance rates in North Carolina, consider the following tips:

Strategies for Finding the Best Rates

- Compare quotes from multiple insurance companies to find the most competitive rates.

- Maintain a good credit score, as it can impact insurance premiums.

- Improve your driving record by avoiding accidents and traffic violations.

Comparison of Insurance Companies in NC: Best Insurance Rates In Nc

Various insurance companies operate in North Carolina, each with its own reputation for customer service and claims handling. When choosing an insurance provider in NC, consider factors such as financial stability, customer reviews, and coverage options to ensure you select a reliable company.

Conclusive Thoughts

In conclusion, finding the best insurance rates in NC is all about understanding the key factors, exploring different types of insurance, and comparing companies. By following the tips Artikeld here, you can secure the most cost-effective coverage for your needs.

Question Bank

How do insurance companies in NC determine their rates?

Insurance companies in North Carolina consider various factors like age, driving record, location, and type of coverage when setting insurance rates.

What types of insurance policies are available in NC?

Common types of insurance in North Carolina include auto, home, health, and life insurance, each offering different coverage options to policyholders.

Why is it important to shop around for insurance quotes in NC?

Shopping around allows you to compare rates from different insurance companies and find the most competitive prices for the coverage you need.