As ocp insurance definition takes center stage, this opening passage beckons readers with formal and friendly language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

OCP insurance, short for Owners and Contractors Protective Liability insurance, is a crucial safeguard for businesses and individuals involved in construction projects. This type of insurance provides coverage for liability risks that may arise during construction activities, offering protection and peace of mind to those involved. Let’s delve deeper into the specifics of OCP insurance and explore its significance in the realm of construction projects.

Definition of OCP Insurance

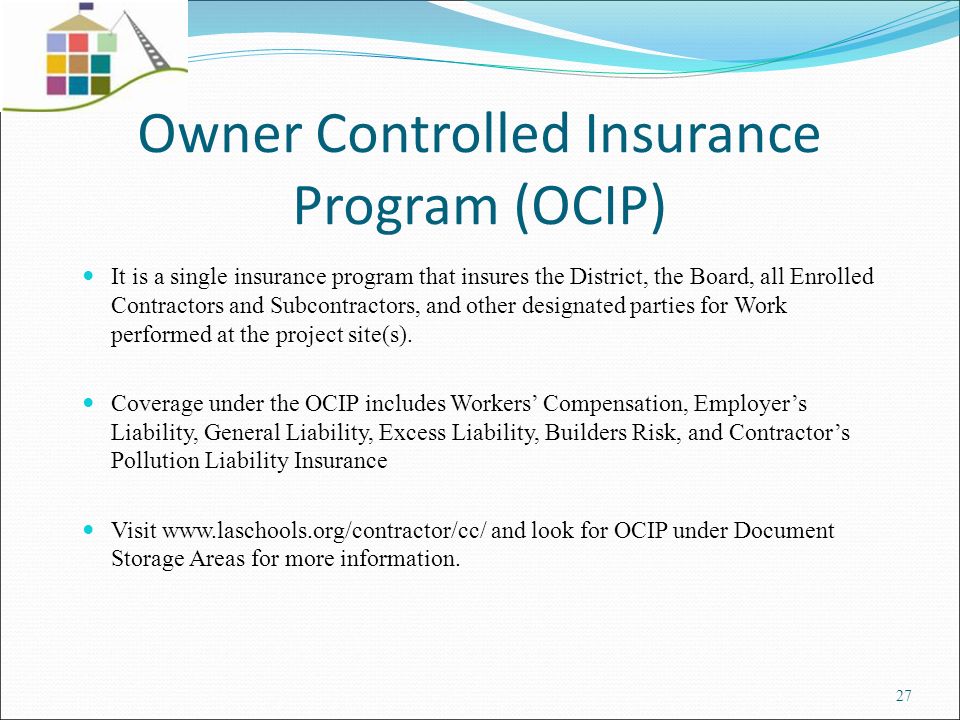

OCP insurance, or Owner’s and Contractor’s Protective Liability insurance, is a type of liability coverage that protects businesses and contractors from liabilities arising out of their ongoing operations. This insurance is typically purchased by the project owner to protect themselves from any potential liabilities caused by the contractors working on their behalf.

Coverage Provided by OCP Insurance, Ocp insurance definition

OCP insurance provides coverage for bodily injury, property damage, and personal injury liability claims that may arise during the course of the project. It also covers legal defense costs associated with these claims.

Examples of situations where OCP insurance would be applicable include a contractor causing property damage while working on a construction site, a subcontractor injuring a third party while performing their duties, or a project owner being sued for negligence related to the work being done on their property.

Importance of OCP Insurance

Businesses need OCP insurance to protect themselves from potential liabilities that could arise during the course of a project. It helps mitigate risks associated with accidents, injuries, or damages that may occur on the job site. OCP insurance also provides a layer of protection for project owners who may be held liable for the actions of their contractors.

OCP insurance differs from other types of insurance, such as general liability insurance, by specifically covering liabilities associated with ongoing operations and projects. It is tailored to the unique risks faced by businesses and contractors working on specific projects.

Types of Coverage

The different types of coverage included in OCP insurance typically encompass bodily injury, property damage, and personal injury liabilities. This coverage is specifically designed to protect businesses and contractors from claims arising out of their ongoing operations.

Comparing OCP insurance to general liability insurance, the former provides more tailored coverage for project-specific liabilities, while the latter offers broader coverage for general business operations. Real-life scenarios, such as a subcontractor causing damage to a neighboring property or an employee injuring themselves on a job site, highlight the importance of each type of coverage included in OCP insurance.

Eligibility and Application Process

Businesses and contractors involved in projects where OCP insurance is required are typically eligible for this type of coverage. The application process for obtaining OCP insurance involves submitting detailed information about the project, contractors involved, and the coverage requirements.

Specific requirements or qualifications needed to apply for OCP insurance may vary depending on the insurance provider and the scope of the project. However, having a comprehensive understanding of the project and its associated risks is essential in securing the right coverage for ongoing operations.

Ending Remarks: Ocp Insurance Definition

In conclusion, understanding the intricacies of OCP insurance is essential for anyone engaged in construction activities. By grasping the definition, coverage, and benefits of OCP insurance, individuals and businesses can proactively protect themselves from potential risks and liabilities, ensuring smoother project execution and overall success.

FAQ Guide

Who typically needs OCP insurance coverage?

Owners, contractors, and subcontractors involved in construction projects often require OCP insurance coverage to safeguard against liability risks specific to the construction industry.

How does OCP insurance differ from general liability insurance?

OCP insurance is tailored to cover liability risks associated with construction projects, while general liability insurance provides broader coverage for a range of business-related liabilities.

Are there specific qualifications needed to apply for OCP insurance?

While eligibility criteria may vary among insurance providers, individuals or businesses seeking OCP insurance typically need to demonstrate their involvement in construction activities to qualify for coverage.