Exploring the concept of personal insurance meaning, this introduction sets the stage for a detailed exploration of the various aspects involved. From defining what personal insurance entails to highlighting its significance in individuals’ lives, this overview aims to provide a comprehensive understanding of the topic.

As we delve deeper into the realm of personal insurance, we will uncover the intricacies of different types, the benefits they offer, key factors to consider when choosing a policy, and the crucial role personal insurance plays in financial planning.

Definition of Personal Insurance

Personal insurance refers to a type of insurance coverage that individuals purchase to protect themselves and their loved ones against financial losses in the event of unexpected circumstances. The main purpose of personal insurance is to provide financial security and peace of mind by offering compensation for medical expenses, property damage, or loss of income due to accidents, illnesses, or other covered events.

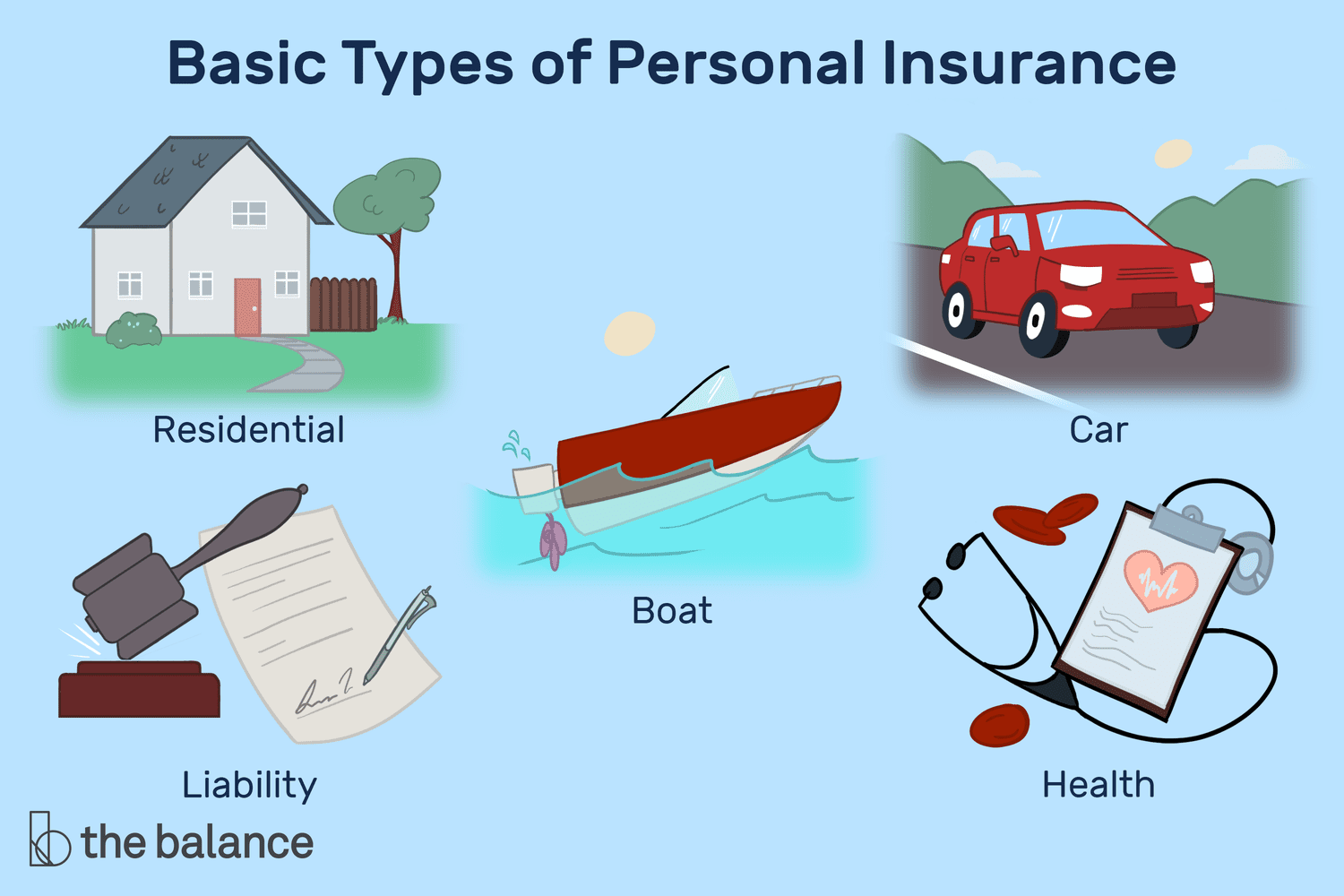

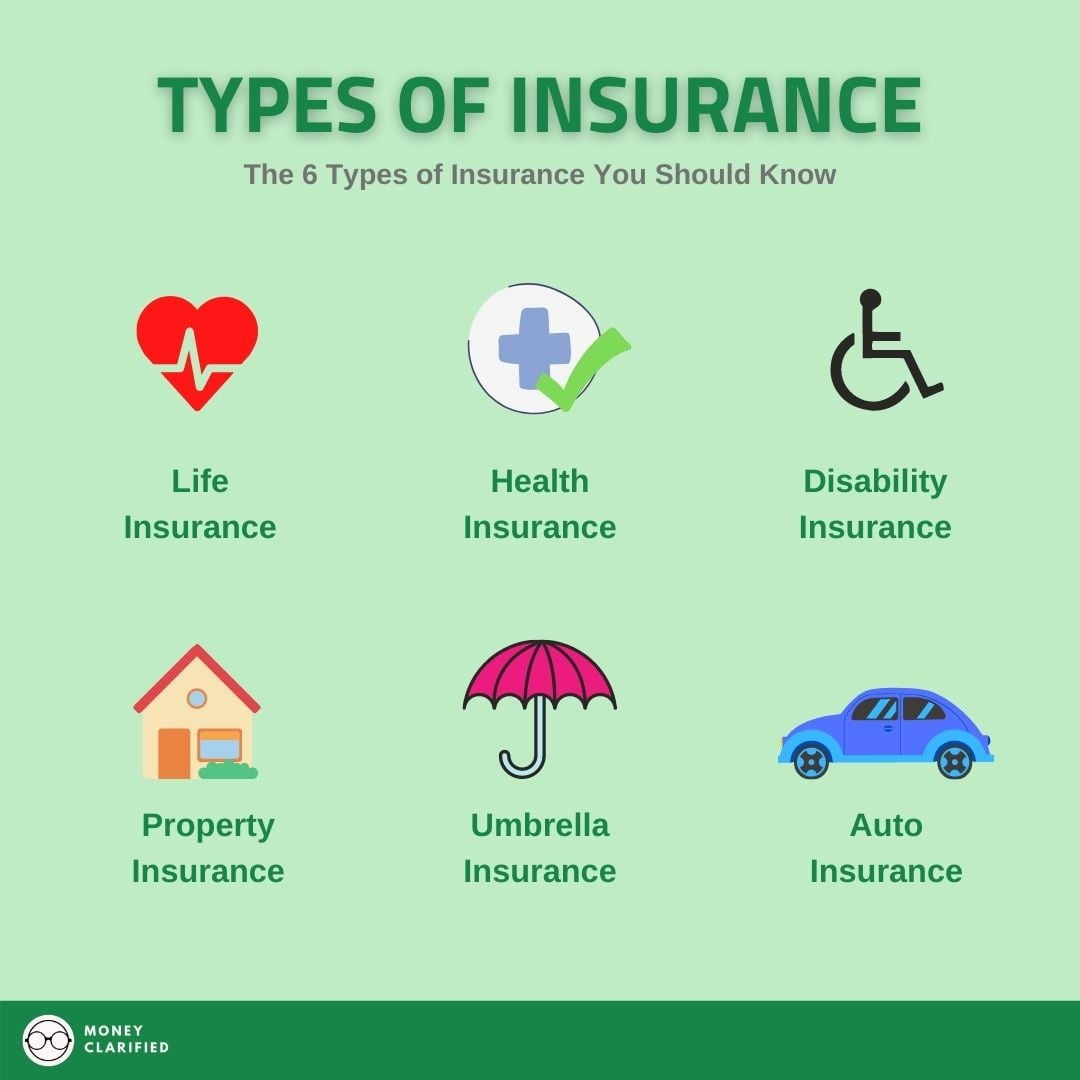

Examples of Common Types of Personal Insurance

- Health Insurance: Covers medical expenses and treatments for illnesses and injuries.

- Life Insurance: Provides financial protection for beneficiaries in the event of the policyholder’s death.

- Auto Insurance: Protects against financial losses related to vehicle accidents and damages.

- Home Insurance: Covers damages to the insured property due to theft, fire, or natural disasters.

Why Personal Insurance is Important for Individuals

Personal insurance is crucial for individuals as it helps mitigate financial risks and uncertainties. It ensures that individuals and their families are protected against unexpected events that could lead to significant financial burdens. By having personal insurance, individuals can have peace of mind knowing that they are financially prepared for unforeseen circumstances.

Types of Personal Insurance: Personal Insurance Meaning

Health Insurance

Health insurance covers medical expenses, hospitalization, and treatments for illnesses and injuries. It helps individuals afford quality healthcare services without worrying about the high costs associated with medical care.

Life Insurance

Life insurance provides a lump sum payment to beneficiaries in the event of the policyholder’s death. It offers financial protection to dependents and ensures that they are taken care of financially even after the policyholder’s passing.

Auto Insurance, Personal insurance meaning

Auto insurance protects individuals against financial losses resulting from vehicle accidents, theft, or damages to their cars. It helps cover repair costs, medical expenses, and liability claims in case of an accident.

Home Insurance

Home insurance covers damages to the insured property caused by theft, fire, natural disasters, or other covered perils. It provides financial protection for homeowners and helps them rebuild or repair their homes in case of unexpected events.

Benefits of Personal Insurance

Personal insurance offers various advantages, including financial protection, peace of mind, and security for individuals and their families. It ensures that individuals can access necessary resources to cover expenses related to emergencies or unforeseen events, reducing the financial burden on them.

Scenarios Where Personal Insurance Can be Beneficial

- During a medical emergency requiring hospitalization and surgery.

- In the event of a car accident resulting in vehicle damage and injuries.

- After a natural disaster causing damage to the insured property.

Financial Security and Peace of Mind

Personal insurance provides individuals with financial security by offering compensation for covered losses or expenses. It gives peace of mind knowing that they are protected against unforeseen events that could impact their financial well-being.

Factors to Consider When Choosing Personal Insurance

Key Factors for Selecting Personal Insurance Policies

When choosing personal insurance, individuals should consider factors such as coverage limits, deductibles, premiums, and policy exclusions. These factors can impact the level of protection and the cost of insurance coverage.

Evaluating and Comparing Different Personal Insurance Options

To make an informed decision, individuals should evaluate and compare multiple insurance options. They can assess the coverage offered, premiums, deductibles, and customer reviews to determine the most suitable insurance policy for their needs.

Importance of Personal Insurance in Financial Planning

Role of Personal Insurance in Financial Planning

Personal insurance plays a crucial role in comprehensive financial planning by safeguarding assets and protecting against financial risks. It ensures that individuals have a safety net in place to handle unexpected events that could impact their financial stability.

Integration into Overall Financial Planning

By integrating personal insurance into their overall financial plan, individuals can create a solid foundation for financial security and long-term stability. It helps them manage risks, protect their assets, and achieve their financial goals with confidence.

Conclusion

In conclusion, personal insurance serves as a vital tool in safeguarding individuals against unforeseen circumstances and providing a sense of security for the future. By understanding the nuances of personal insurance meaning, individuals can make informed decisions to protect themselves and their loved ones effectively.

FAQs

What does personal insurance cover?

Personal insurance typically covers various aspects such as health, life, auto, and home insurance to protect individuals from financial losses due to unexpected events.

How does personal insurance benefit individuals?

Personal insurance provides financial security, peace of mind, and protection against unforeseen circumstances by covering expenses related to accidents, illnesses, or property damage.

What factors should be considered when choosing a personal insurance policy?

Key factors to consider include coverage limits, deductibles, premiums, exclusions, and the reputation of the insurance provider to ensure adequate protection tailored to individual needs.